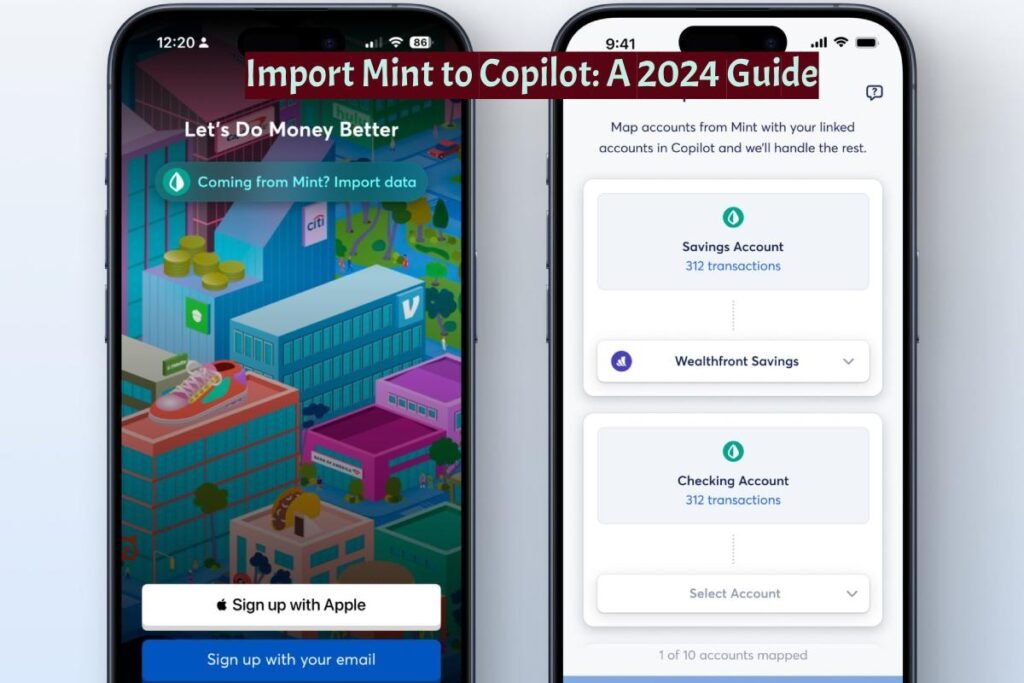

Import Mint to Copilot: Copilot’s Mint Transaction Import feature, available on both iOS and Mac, allows users to import their financial history from Mint, a popular personal finance tool. This integration means you can now consolidate your financial data into Copilot, benefiting from its advanced tracking and budgeting tools.

Managing personal finances has never been easier with the latest updates from Copilot, which now include a feature to import your historical Mint transactions. This new capability is designed for both new and existing users, offering a smooth transition of your financial data. Here’s a comprehensive guide to help you through the process.

Importing Your Mint Data into Copilot

Copilot’s latest feature, the Mint Transaction Import, enables both new and existing users to seamlessly transfer their historical Mint transactions into Copilot. This functionality is now available on both iOS and Mac platforms.

Getting Started:

New Users: During the onboarding process, you’ll have the option to import your Mint transactions directly into Copilot.

Existing Users: Navigate to Settings > Import Mint Data to begin importing your Mint transactions.

What to Expect:

- Transaction Visibility: You’ll be able to view your Mint transactions within Copilot.

- Balance Calculations: Although Mint’s export files don’t include balances, Copilot will compute your historical balances for the spending accounts you import, based on the transactions.

- Custom Categories: Your custom spending categories from Mint will be preserved in Copilot.

- Transaction Notes: Transaction tags from Mint will appear as notes in Copilot.

Step-by-Step Guide to Importing Mint Data

- Export from Mint: Log in to your Mint account and export your transaction history. Mint will provide this data in CSV files, each containing up to 10,000 transactions.

- Import to Copilot: Open the Copilot app on your iOS or Mac device and navigate to Settings > Import Mint Data. Select the files you exported from Mint and initiate the import process.

- Account Mapping: Match the accounts from Mint to your corresponding Copilot accounts. This step ensures that all transactions are accurately categorized and linked.

- Data Prioritization: In cases where there is overlap between Mint and Copilot data, choose whether to prioritize data from Mint or Copilot.

Limitations

- Net Worth & Account Balances: Any accounts that are not the depository accounts or credit cards cannot be imported. Also, the historical net worth and balances for any loan or investment accounts cannot be imported.

- Budgets: Mint budgets will not be transferred over.

Can I Still Export Data from Mint in 2024?

As of 2024, Mint continues to provide users with the ability to export their financial data.

This feature is crucial for those who want to keep a personal backup of their transactions, switch to a different financial management tool, or conduct more detailed analyses.

We will explore how to download CSV files from Mint, the applications of exported data, and upcoming trends in financial data management.

How to Download CSV from Mint

Exporting data from Mint is a straightforward process. Here’s a step-by-step guide to help you download your transaction history as a CSV file:

- Log in to Your Mint Account:

- Open your web browser and go to the Mint website.

- Enter your personal login credentials to access the account dashboard.

- Navigate to Transactions:

- Once logged in, go to the “Transactions” tab. This section displays all your financial transactions across linked accounts.

- Select the Export Option:

- Look for the “Export” button, typically located at the top right corner of the transactions list.

- Click on “Export all transactions.” Mint will compile your transaction data into a CSV file.

- Download the CSV File:

- A prompt will appear to download the CSV file.

- Save the file to your desired location on your computer.

This CSV file will contain detailed information about your transactions, including dates, descriptions, categories, and amounts, which you can use for various purposes.

Applications of Exported Mint Data

Exported Mint data can be incredibly useful for various applications, including:

- Personal Backup:

- Keeping a personal backup of your financial data ensures you have access to your transaction history, even if you stop using Mint.

- Transition to Other Financial Tools:

- If you decide to switch to another financial management tool, like Copilot or YNAB, exporting your data from Mint makes the transition smoother by allowing you to import your historical transactions.

- Detailed Financial Analysis:

- Use the CSV file to perform in-depth analyses of your spending habits, income trends, and budgeting patterns using spreadsheet software like Microsoft Excel or Google Sheets.

- Tax Preparation:

- Having a comprehensive record of your transactions can simplify tax preparation, helping you track deductible expenses and prepare accurate financial reports.

Best Practices and Tips:

- Large Exports: Mint exports data in batches of up to 10,000 transactions per file. If you have a large number of transactions, you might need to import multiple files. The Copilot Mac app allows simultaneous import of several files.

- Missing Data: If you notice any missing historical data after import, try clearing the app’s cache via the settings menu to re-sync the data.

- Data Management: You can delete all imported Mint data anytime through the Settings menu.

Upcoming Updates and Trends in Financial Data Management

As technology evolves, so do the tools and features available for managing personal finances. Here are some upcoming updates and trends to watch for in 2024:

- Enhanced Data Security:

- With increasing concerns about data privacy, financial tools are focusing on enhancing data security measures to protect users’ sensitive information.

- AI-Driven Insights:

- Artificial Intelligence (AI) is being integrated into financial management tools to provide users with smarter insights and personalized financial advice based on their transaction history and spending patterns.

- Improved Interoperability:

- Financial apps are working towards better interoperability, allowing seamless data transfer between different platforms. This trend aims to reduce friction for users who want to switch tools or integrate multiple financial services.

- Real-Time Synchronization:

- Real-time synchronization of transactions and balances is becoming more prevalent, offering users up-to-date views of their financial status across all linked accounts.

- Expanded Budgeting Features:

- Advanced budgeting tools that offer more granular control and develop forecasting capabilities, enabling users to plan their finances with greater accuracy and flexibility.

- Blockchain Integration:

- Some financial tools are exploring the integration of blockchain technology to ensure transaction transparency and security, potentially revolutionizing how financial data is managed and stored.

Conclusion

With Copilot’s new Mint Transaction Import feature, managing your finances has become more streamlined and efficient. Whether you’re a new user setting up your financial tracking or an existing user looking to consolidate your data, this guide provides all the necessary steps and tips to ensure a smooth transition. By importing your Mint data into Copilot, you can take advantage of Copilot’s advanced features and have a unified view of your financial history in one place.

FAQ’s

Can You Import Mint Data into Copilot?

Moving Your Mint Data to Copilot | Copilot Help Center

Copilot’s new Mint Transaction Import feature allows both new and existing users to import their historical Mint transactions. We’re excited to offer this feature on both iOS and Mac platforms. As a new user, you can import Mint transactions during your onboarding process.

What to Use Now That Mint is Gone?

With Intuit shutting down Mint, many users are looking for alternative budgeting apps.

- Quicken Simplifi: The best overall Mint alternative.

- Monarch Money: The best alternative for managing money.

- Copilot Money: The best up-and-comer.

- NerdWallet: The best free budgeting app.

Is Mint Going Away in 2024?

Yes, Mint goes offline on March 23, 2024. However, there are many other budgeting apps available to help you manage your finances effectively.